Frankfurt, 10/01/2024. The possible effects of the elimination of the so-called utility cost billing privilege were investigated for the first time in the Autumn Wave of the Platform Study 2023 conducted by Kantar on behalf of AGF Videoforschung. The new amended version of the German Telecommunications Act includes a provision to the effect that cable fees may no longer be charged to renters as utility costs.

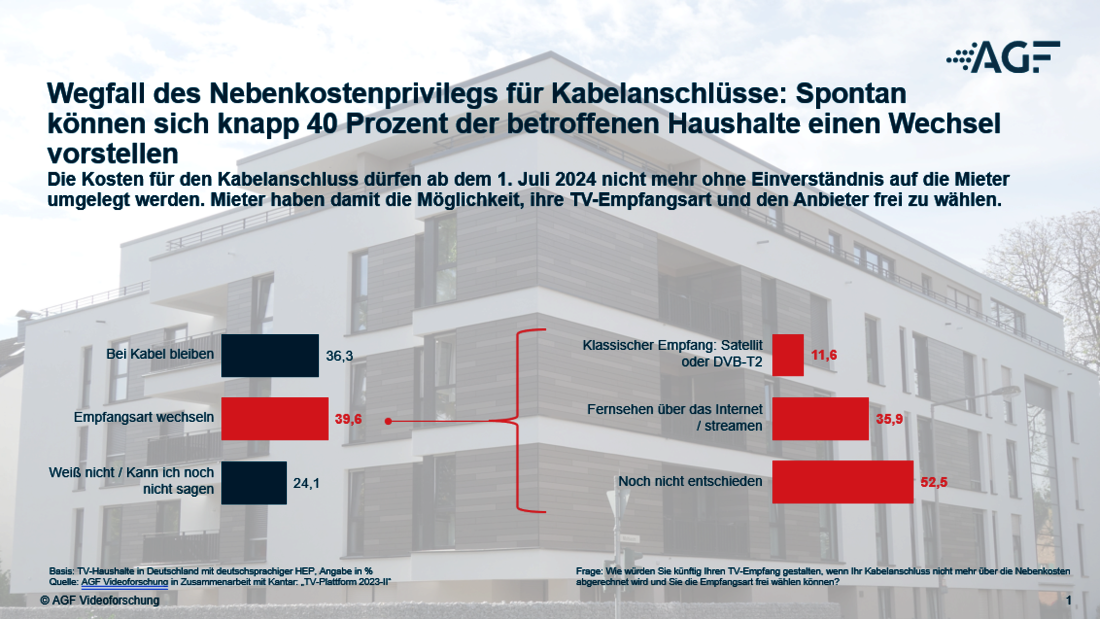

This change will affect about 6.6 million households with reception level cable in Germany whose cable fees are charged by the lessor together with utility costs, regardless of whether they actually use the cable connection. Only 14.0 percent of survey respondents in the affected households have given some thought to this issue. About 36 percent of all respondents stated spontaneously that they want to keep the cable connection. About 40 percent indicated that they might change the mode of reception, although more than half of these respondents do not yet know which mode of reception they would choose. One third of them indicated Internet Protocol Television (IPTV) as a possible alternative to their cable connection.

Kerstin Niederauer-Kopf, CEO of AGF Videoforschung, says: “The elimination of the utility cost billing privilege presents a great opportunity for various different distributors and services that are already established in the market. It should also be remembered that the number of smart TVs in use has risen considerably in the last few years. Therefore, we will follow the “cord-cutting” trend with great interest as 6.6 million households could potentially choose new services in the coming months.”

Internet usage hits a new record high

The latest Platform Study also shows that Internet usage has reached a new record high of 90.6 percent. Internet usage on smart TVs has likewise risen steadily from 59.5 percent in the preceding wave to 61.5 percent in the latest wave. Moreover, Internet usage on a PC or laptop has risen from 72.3 percent in the preceding wave to now 74.8 percent, while Internet usage on a smartphone remained at the high level of 84.5 percent. Two thirds of respondents stated that they use the Internet on three or more devices, representing a modest increase over the corresponding percentage in the preceding wave.

Those that use the online video services of TV broadcasters or streaming providers still prefer TV sets for this purpose. Specifically, 87.3 percent of Netflix users, 83.4 percent of Amazon Prime Video users, 76.1 percent of Disney+ users, and 74.2 percent of those that use the online services of TV broadcasters watch TV on TV sets. By contrast, smartphones are preferred for brief clips and news: 76.5 percent of YouTube users and 66.2 percent of those who watch videos on news portals consume this content on smartphones.

Kerstin Niederauer-Kopf draws the following conclusions from this data: “As more users watch TV on their couches, they tend to prefer bigger screens for both the video services of TV broadcasters and those of streaming platforms. For long-form content, viewers clearly prefer to watch TV while sitting on their couch, whereas smartphones are preferred as the best way to grab information on the go, while waiting for the bus or taking a break from work, for example.”

Streaming use holds steady

After rising markedly from the Spring Wave 2022 to the Spring Wave 2023, streaming use held steady at 68.4 percent in the latest survey, compared to 68.2 percent in the last survey.

In the meantime, people of all age groups are using streaming services: 89.3 percent of all 14-to-29 year-olds, 88.2 percent of 30-to-49 year-olds, 76.5 percent of 50-to-64 year-olds, and 44.5 percent of users over 65 watched online video content from TV broadcasters or streaming platforms in the last four weeks. And for the first time ever, more than half of respondents in the Autumn Wave 2023 indicated that they have used a paid VoD service.

Methodology

For the Platform Study, which has been conducted on behalf of AGF Videoforschung since 2011, the market research institute Kantar surveys around 2,500 respondents from the German-speaking population aged 14 and older in TV households, in two waves per year. The survey is carried out in the respondents’ homes. The responses to detailed questions concerning sociodemographic background, online and streaming use, TV equipment and receivable programs are validated by an inspection of the type of TV equipment used in the household and the programs that can actually be received. The representative study delivers up-to-date specifications about the potential and distribution of households with a platform and therefore serves as an external specification for structural panel control and for the weighting and extrapolation of platform households. It also provides information about Video-on-Demand use, especially on those services that are not tracked by AGF. The results of the Platform Study are also a key component of AGF’s external specification.