Frankfurt, July 3, 2025. The latest wave of the AGF Platform Study 2025 I reveals: the TV market remains dynamic. Following the abolition of the service charge privilege on July 1, 2024, 72.4 percent of affected households have signed new cable TV contracts. At the same time, alternative forms of TV reception are gaining significance. The ARD’s switch-off of SD broadcasting on January 7, 2025, went smoothly — 90.1 percent of households had already transitioned to HD.

For the first time, the study also examined remote control usage: nearly half of all households now have a platform button on their primary remote for direct access to streaming apps.

End of Service Charge Privilege: Increase in Cable Contracts and New Reception Methods

In this latest wave of the AGF Platform Study, conducted from early February to early April 2025, respondents were once again asked about the impact of the discontinued service charge privilege. Trends identified in the autumn 2024 wave have continued and intensified.

The share of households signing a new cable contract has risen by nearly ten percentage points. In Wave I 2025, 72.4 percent of affected households report having signed a new cable agreement. A notable increase was seen particularly among collective cable contracts, such as those used by apartment communities.

Alternative reception methods are also seeing growth. The share of households switching to a different form of reception has nearly doubled: while only 6.8 percent of former cable users reported switching to an alternative reception method in the previous wave, this figure rose to 12.6 percent in the current wave. The majority of new contracts involve TV over the internet.

Among the 27.6 percent of households that did not sign a new cable contract, 45.9 percent are still able to receive cable TV — a sharp drop from nearly 68 percent in the prior wave.

ARD SD Switch-Off: No Major Impact Observed

The SD switch-off of ARD programming in January 2025 was also evaluated in this wave. Results show that for the vast majority of respondents, the transition from SD to HD had little to no noticeable impact.

90.1 percent of households were already equipped for HD reception — either because they were already watching in HD, or because their devices were HD-capable and required only a channel search.

Only a small group needed to take action: 1.8 percent reported having purchased a new HD-capable device or router, while another 1.8 percent had not yet responded to the change and currently cannot receive ARD programming. The findings refer to the primary TV device in each household.

Connected TV: Internet Access Verified Directly at Device Level

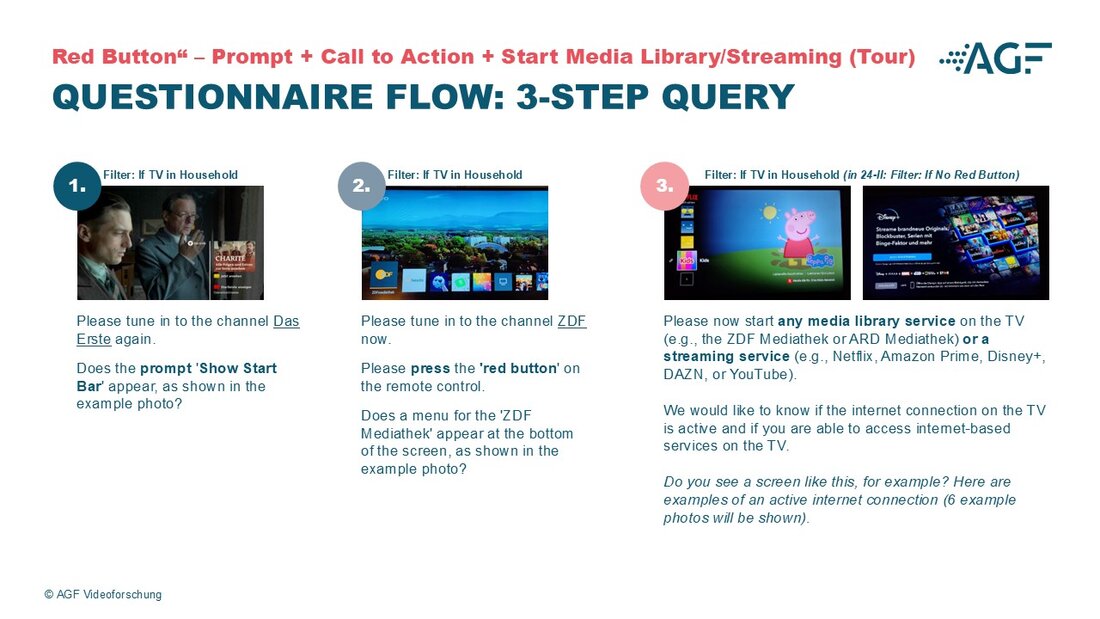

For the first time, this wave of the AGF Platform Study included technical validation of internet access directly at the TV device. This enhances the study’s scope in terms of technical accuracy.

An active internet connection at the device was confirmed in 69.0 percent of surveyed households — higher than the previously reported 61.4 percent, which was based solely on self-reporting.

Remote Controls in Focus: App Access and Device Startup Behavior

Also for the first time, the study examined remote control setup and usage. Findings show that platform buttons are widespread: 47.0 percent of households have remotes with direct access to apps. Among those with access, 59.0 percent use the buttons at least occasionally.

Traditional controls remain relevant as well: numeric buttons are present on nearly all remotes, and are still actively used by 80.9 percent of households.

The study also investigated startup behavior: in around 74 percent of households, the TV starts with the live TV program, while in roughly one quarter, it first displays a user interface with app access.

"The results show how adaptable TV households in Germany are," says Kerstin Niederauer-Kopf, CEO of AGF. "We see a high level of flexibility in both technical equipment and user behavior in response to ongoing market changes."

Methodological Overview

Since 2011, the AGF Platform Study has been conducted twice a year by Kantar on behalf of AGF Videoforschung. Each wave includes around 2,500 participants aged 14 and older from German-speaking households with a TV. The study is conducted in person in respondents’ homes.

In addition to in-depth interviews on sociodemographics, online and streaming use, device equipment, and available channels, key data is also validated directly by inspecting the devices and switching channels.

The representative study provides current data on the reach and distribution of households with access to pay TV, and serves as an external benchmark for panel management, weighting, and projection of platform households. The results are also a core component of AGF’s external control framework.