Frankfurt, January 21, 2026 – The television set remains the central screen in German households. At the same time, the results of the current AGF Platform Study 2025 II show that the structural framework of TV usage continues to change. New reception methods, internet-enabled devices, and evolving user interfaces are increasingly shaping access to video content - both in linear television and within the growing range of streaming services.

TV reception: Internet gains significant ground – traditional reception methods decline

The distribution of reception platforms identified in the platform study forms the basis for the target specifications within the AGF system.

Current data show a marked increase to 17.7 percent of TV households using internet-based reception, compared to the previous year (2025: 11.3 percent). At the same time, all traditional reception methods are losing share: cable declines to 36.2 percent (2025: 40.0 percent), while terrestrial reception falls to 2.8 percent (2025: 3.5 percent).

Satellite remains the most widely used reception method at 43.4 percent, although it also records a slight decline compared to the previous year (2025: 45.2 percent). As IP-based reception methods continue to spread, entry points into TV usage are also changing: alongside traditional linear programming, user interfaces and app-based content structures are increasingly coming to the fore.

Connected TV is well established

In the current autumn wave 2025 II, at least one internet-connected television set was identified in 70.3 percent of the surveyed and on-site visited TV households as part of the technical assessment. This figure is at a similar level to the previous spring wave 2025 I (69.0 percent) and underlines the stable penetration of Connected TV in German TV households. The majority of internet-capable TV sets are directly connected to the internet (57.9 percent).

A further 15.2 percent of Connected TVs receive internet connectivity via additional devices such as streaming sticks or streaming boxes—representing a slight increase compared to the previous wave 2025 I (14.3 percent).

A key structural driver behind these developments is the modernization of the device base: around 50 percent of television sets used in surveyed households are less than five years old. As a result, modern devices with up-to-date operating systems, user interfaces, and streaming functions are widely available, making the growing importance of internet-based access and usage technologies plausible.

Growing importance of user interfaces

In the current wave, 30.3 percent of respondents first see a user interface rather than a running program when switching on the television. Within internet-based reception methods, televisions start directly with a user interface in 68.8 percent of households in the current wave. Content is therefore increasingly selected via tiles, recommendations, or app structures—a defining characteristic of today’s streaming environment.

Despite changing access paths, broadcasters’ offerings remain a central component of video usage. In the autumn wave 2025 II, 77.1 percent of respondents continue to use the traditional numeric keypad on the remote control (previous wave 2025 I: 80.9 percent).

Remote control as the central navigation tool

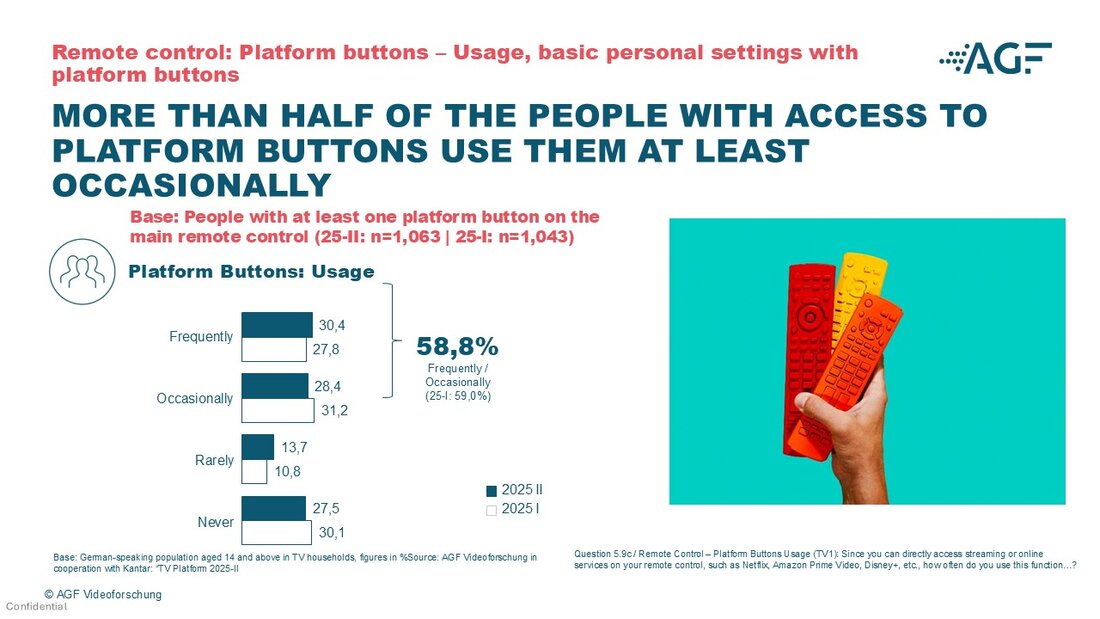

In the autumn wave 2025 II, 46.7 percent of respondents stated that platform buttons are integrated into their remote controls - virtually unchanged compared to the spring wave 2025 I (47.0 percent). Among users with such buttons, 58.8 percent use them frequently or occasionally (previous wave 2025 I: 59.0 percent). Almost all platform buttons provide direct access to Netflix (43.2 percent), followed by Amazon Prime Video (35.0 percent) and YouTube (23.8 percent).

Voice control: Usage lags behind availability

Voice control was measured for the first time as a separate aspect in the platform study. In the autumn wave 2025 II, 33.3 percent of households have a voice control button on their remote control. However, this feature is currently used by only 14.8 percent of households. The results show that voice control presently serves primarily as a supplementary function, while traditional navigation methods continue to dominate.

Significant increase in YouTube and social media usage – broadcasters hold their own in the streaming environment

Overall, streaming usage on VOD platforms rose to 75.6 percent in the autumn wave (2025 I: 72.3 percent). The strongest increases were recorded by YouTube at 61.0 percent (2025 I: 56.4 percent) and social media platforms at 42.5 percent (2025 I: 38.3 percent). In the current wave, 44.7 percent of respondents stated that they use the online offerings of TV broadcasters. Video streaming providers Netflix (37.5 percent, previous wave 35.1 percent) and Amazon Prime Video (28.8 percent, previous wave 26.4 percent) also saw growth.

With the exception of YouTube and social media platforms, this usage predominantly takes place via smart TV devices. Broadcasters are therefore holding their ground in the competition with streaming and on-demand services, successfully combining linear programming and media libraries in everyday usage.

Abolition of the ancillary cost privilege: Transition largely completed

More than one year after the abolition of the ancillary cost privilege, only moderate changes are evident compared to the previous wave 2025 I. By now, 74.4 percent of affected households have concluded a new cable contract (previous wave 2025 I: 72.4 percent), while 15.9 percent have switched to a new reception method (previous wave 2025 I: 12.6 percent).

However, technical availability has changed significantly: among affected households without a new cable contract, only 33.4 percent are still able to receive cable television—a sharp decline compared to the previous wave (45.9 percent). In this context, 52.6 percent of affected households report having been contacted by their cable provider after July 1, 2024.

Context within the AGF Annual Report 2025

The results of Platform Study 2025 II complement the AGF Annual Report published at the beginning of the year. Changes in linear viewing time must be viewed against the backdrop of new reception methods, modern devices, and an expanded streaming offering. The study highlights that access and selection mechanisms are also evolving.

“The platform study complements our Annual Report 2025 with important contextual insights: changes in linear TV usage can be understood through the interaction of multiple factors. New access routes and reception situations are changing how viewers begin their viewing journey, while at the same time the diversity of offerings is growing and content is competing more intensely for audience attention. The importance of the TV set as the central screen for video usage remains undisputed - usage today simply takes place under altered structural conditions,”explains Kerstin Niederauer-Kopf, Chairwoman of the Executive Management Board of AGF.

Methodological overview

For the platform study, the market research institute Kantar has been surveying approximately 2,500 participants per wave from the German-speaking population aged 14 and over in TV households on behalf of AGF Videoforschung twice a year since 2011. The study is conducted in respondents’ households. In addition to a detailed interview covering sociodemographics, online and streaming usage, TV equipment, and available channels, relevant information is also validated through inspection of devices and by switching on programs.

The representative study provides up-to-date benchmarks on the potential and distribution of households with access to pay TV and serves as an external benchmark for structural panel management as well as for weighting and projection of platform households. The results of the platform study are also a central component of AGF’s external benchmarks.

Wave 2025 II: Fieldwork period July 14 – September 15, 2025; n = 2,526 interviews, including n = 2,363 surveyed and visited TV households. Unless otherwise stated, the figures refer to the autumn wave 2025 II; comparative figures are explicitly indicated as the previous wave (2025 I) or as a year-on-year comparison (2024 II).