Frankfurt, January 8, 2026 – The year 2025 marks a decisive step forward in the development of moving-image measurement in Germany. With the active integration of Amazon Prime Video into the AGF measurement system, a global streaming provider has been successfully incorporated into a certified and neutral measurement system via a server-to-server integration. Since November 2025, Prime Video’s ad-funded VOD content has been reported comparably at content level alongside broadcasters’ offerings in AGF tools. The video year 2025 is characterized by the continuing diversification of the media landscape and changing usage situations. While the consumption of video content is increasingly distributed across different distribution paths and providers, linear or live television remains a core component of the media market—especially for current, socially relevant content and events experienced live.

Linear television in the Moving Image Market Standard

Within the Moving Image Market Standard, in 2025 an average of 55.5 percent of viewers aged 3+ - or 43.789 million viewers (1 consecutive minute) - tuned in daily to a wide range of TV formats from programme providers.

In 2025, average daily TV viewing time among people aged 3+ was 158 minutes, representing a decline of 7.7 percent versus the previous year (171 minutes). Among 14- to 49-year-olds, average viewing time was 67 minutes (2024: 79 minutes). This decline reflects an increasingly dynamic and fragmenting media market—meaning the question is no longer simply whether TV audience losses are due to viewers preferring streaming, but also that target groups are shifting attention to entirely new media focal points, such as social media (e.g., TikTok) or gaming. In addition, technological changes—such as app-based access to content via the big screen, or changes in reception situations—also influence traditional linear TV usage. Due to dynamic inter- and intramedia fragmentation, an ever-growing share of total usage time is spread across a wide variety of offerings, platforms, and usage situations. Even in this oversupply, one old truth remains unbroken: content is king. To evaluate video content reliably, valid audience measurement is essential—especially in a highly competitive environment.

“Despite this dynamic development and the emerging trend that everyone is now fighting for the same thing, 2025 also shows that linear television continues to achieve high reach where content provides immediacy, orientation, and an event character. News, special broadcasts, and live transmissions remain a fixed point of reference for many viewers in their daily media consumption. With the integration of international platforms and progress in hybrid measurement, we must consistently expand our toolkit and integrate new offerings to reflect the overall performance of the moving-image market. For AGF, it is important to provide the market with a consistent and comparable reach model that reliably captures both changes in linear television and developments in the digital space,” says Kerstin Niederauer-Kopf, Chairwoman of the Executive Management Board of AGF Videoforschung.

Information programming: High attention for current and socially relevant topics as well as political events in Germany and abroad

The usage share of information formats—including news, magazines, reports and documentaries, as well as talk shows - amounted to around 36 percent of total linear TV usage in 2025, slightly above previous years.

The year 2025 was shaped by political and social events in Germany and abroad, alongside a challenging overall economic situation.

Despite the ongoing “crisis mode,” German viewers’ interest in information remained consistently high in 2025 and was met primarily by classic daily news media—above all television. Coverage focused, among other topics, on the early federal election held on February 23, 2025. This was triggered by the collapse of the “traffic light” coalition in November 2024. It is therefore no surprise that one of the year’s most successful broadcasts was Tagesschau on Das Erste on February 23, 2025 at 8:00 p.m.: an average of 11.097 million viewers (35.8% market share) followed the first projections of the election results, which simultaneously signaled a major political shift in the country.

The major TV debates ahead of the election also attracted particularly high attention. “Das Duell – Scholz gegen Merz,” broadcast simultaneously on Das Erste, ZDF, Phoenix and Tagesschau24 in February, achieved total viewing of 12.920 million, corresponding to a 41.9 percent market share. “RTL/ntv: Das Quadrell – Kampf ums Kanzleramt,” also aired in February on RTL and ntv, was watched by an average of 8.593 million viewers across both channels (27.7% market share). This debate also generated strong interest among 14- to 49-year-olds on the commercial channels, reaching a 47.2 percent market share in this target group.

The chancellor election in May 2025 was also closely covered. Friedrich Merz was elected Federal Chancellor on May 6, 2025 in the second round of voting, replacing Olaf Scholz. “Brennpunkt: Das Drama um die Kanzlerwahl” drew 5.966 million viewers (23.9% market share). Overall, 53.101 million viewers came into contact at least once with a linear broadcast related to the February election. Looking at the convergent figures (53.431 million)—i.e., total viewers across linear and streaming—it is evident that coverage around the federal election was clearly concentrated on linear usage, while exclusive streaming usage made up only a small share. Broadcasts around the election of Friedrich Merz in May reached 23.053 million viewers via linear reception and on demand; however, 23.012 million of these tuned into a linear TV format.

USA: Donald Trump’s first year in office in the focus of coverage

International political developments also contributed to spikes in attention for information programming in 2025, including events connected to the second term of U.S. President Donald Trump. The inauguration, foreign policy decisions around U.S. tax and trade policy, as well as diplomatic escalations each led to short-term, significantly increased usage of news and special broadcasts. The inauguration on January 20, 2025 was covered extensively: “ZDF spezial: Donald Trump zurück an der Macht – Amtseinführung” was watched by 3.680 million viewers (16.4% market share). Coverage of the visit by Ukrainian President Volodymyr Zelenskyy reached 6.828 million people (27.4% market share) in “Brennpunkt: Eklat im Weißen Haus” on Das Erste on March 1. The conflict in the Middle East also continued to receive strong attention. “Brennpunkt: Krieg zwischen Israel und Iran – USA greifen ein” on June 22, 2025 at 8:15 p.m. was watched by an average of 6.954 million viewers (31.2% market share).

“Overall, the stability of information-program usage shows one thing: in the case of complex, current, or live-perceived events, linear television remains an established frame of reference for context and orientation. In an increasingly fragmented media environment, linear TV is used particularly when content calls for an immediate, shared viewing experience,” says Niederauer-Kopf.

Religious events drive viewing peaks

The death of Pope Francis also moved people in front of their screens—just like the election of his successor. The special broadcast “Brennpunkt: Trauer um Papst Franziskus” on Das Erste was watched by an average of 4.564 million viewers (17.7% market share) on April 21, 2025. The live transmission of the subsequent election of his successor Pope Leo XIV in “ZDF spezial: Der neue Papst ist gewählt” at around 6:00 p.m. was watched by an average of 3.820 million viewers (21.2% market share). The following “Brennpunkt: Konklave hat neuen Papst gewählt” at 8:15 p.m. on Das Erste drew an average of 5.978 million viewers (24.8% market share).

High interest is also reflected in the convergent usage view: across all linear and streamed TV offerings, broadcasts around the death of Pope Francis as well as the election and inauguration of Pope Leo XIV reached a cumulative total of 41.600 million people. Of these, 41.391 million tuned in at least once to the linear broadcasts.

The most successful TV formats of 2025

Live sport: Football and the women’s national team as ratings highlights

2025 was not a classic major sports-event year—something that is also clearly reflected in overall TV usage. Neither the Olympic Games nor a men’s FIFA World Cup or UEFA European Championship shaped the TV sports calendar. Nevertheless, several sports broadcasts ranked among the year’s highest-reach programmes. “Queen Football” once again proved to be a reliable reach driver for linear television. Among the top 5 across all channels and programmes are two football matches—both featuring the women’s national team. By far the highest-reach programme of the year was the match Germany vs. Spain on July 23, 2025 on Das Erste, as part of the UEFA Women’s European Championship. Across the total audience, an average of 14.573 million people watched the match, corresponding to a 57.0 percent market share. Among 14- to 49-year-olds, the match also leads the year-end ranking: an average of 4.379 million viewers (68.2% market share) watched the game on linear television.

Tatort on Das Erste also impressed in 2025 with its proven continuity and secured positions two and three in the list of most popular formats among the total audience. “Tatort: Fiderallala” on April 6, 2025 drew an average of 12.508 million viewers aged 3+ (42.5% market share), followed by “Tatort: Die Erfindung des Rades” on December 7, 2025 with 12.200 million viewers (43.1% market share).

In the year-end ranking for 14- to 49-year-olds, programme preferences differ in part from those of the total audience. Here, live sport and entertainment dominate—such as the live broadcast of the ESC in Basel on Das Erste—or information programming, such as “RTL/ntv: Quadrell – Kampf ums Kanzleramt” or Tagesschau on February 23, 2025 on Das Erste.

Entertainment shows remain popular on TV

The decades-long success story of the Eurovision Song Contest once again reached a broad audience. With an average of 8.868 million viewers (43.9% market share)—including 3.674 million in the 14–49 target group (59.8% market share) - the live show from Basel ranked first in both target groups among all entertainment programmes. Further places among the total audience were: in second place “75 Jahre ARD – die große Jubiläumsshow” with 6.705 million viewers and 29.6 percent market share; heute-show on ZDF in places three and five; and “Klein gegen Groß – Das unglaubliche Duell” on Das Erste in fourth place. Among 14- to 49-year-olds, places two to five behind the ESC were taken by episodes of the long-running RTL format “Ich bin ein Star – Holt mich hier raus!”.

Top 5 TV formats 2025 (all): Total audience

(Mon–Sun, 3 a.m.–3 a.m.) | Average audience | Market share | Minimum programme length: 10 minutes

Rank | Title, channel and date | Audience (millions) | Audience share in % | |

1. | „Fußball-EM Frauen: Deutschland - Spanien“ (Das Erste, 23.07.2025) | 14,573 | 57,0% | |

2. | „Tatort: Fiderallala“ (Das Erste, 06.04.2025) | 12,508 | 42,5% | |

3. | „Tatort: Die Erfindung des Rades“ (Das Erste, 07.12.2025) | 12,200 | 43,1% | |

4. | „Tagesschau“ (Das Erste, 23.02.2025) | 11,097 | 35,8% | |

5. | „sportstudio live-UEFA FR-EM 2025: Frankreich – Deutschl.“ (ZDF,19.07.2025) | 10,919 | 51,7% |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: TV; convention; package no.: 16906 of 08/01/2026

Top 5 TV formats 2025 (all): 14–49 years

(Mon–Sun, 3 a.m.–3 a.m.) | Average audience | Market share | Minimum programme length: 10 minutes

Rank | Title, channel and date | Audience (millions) | Audience share in % | |

1. | „Fußball-EM Frauen: Deutschland - Spanien“ (Das Erste, 23.07.2025) | 4,379 | 68,2% | |

2. | „ESC – Das Finale aus Basel“ (Das Erste, 17.05.2025) | 3,674 | 59,8% | |

3. | „RTL/NTV: DAS QUADRELL – KAMPF UMS KANZLERAMT“ (RTL, 16.02.2025) | 3,404 | 43,9% | |

4. | „RTL FUSSBALL: DEUTSCHLAND – ITALIEN, 2. HÄLFTE“ (RTL, 23.03.2025) | 3,374 | 50,2% | |

5. | „Tagesschau“ (Das Erste, 23.02.2025) | 3,283 | 40,4% |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: TV; convention; package no.: 16906 of 08/01/2026

Top 5 TV formats 2025 (Entertainment): Total audience

(Mon–Sun, 3 a.m.–3 a.m.) | Average audience | Market share | Minimum programme length: 10 minutes

Rank | Title, channel and date | Audience (millions) | Audience share in % | |

1. | „ESC - Das Finale aus Basel“ (Das Erste,17.05.2025) | 8,868 | 43,9% | |

2. | „75 Jahre ARD - Die große Jubiläumsshow“ (Das Erste, 05.04.2025) | 6,705 | 29,6% | |

3. | „heute-show“ (ZDF, 28.02.2025) | 5,465 | 23,1% | |

4. | „Klein gegen Groß - Das unglaubliche Duell“ (Das Erste, 04.01.2025) | 5,275 | 21,7% | |

5. | „heute-show“ (ZDF, 07.03.2025) | 5,262 | 25,5% |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: TV; convention; package no.: 16906 of 08/01/2026

Top 5 TV formats 2025 (Entertainment): 14–49 years

(Mon–Sun, 3 a.m.–3 a.m.) | Average audience | Market share | Minimum programme length: 10 minutes

Rank | Title, channel and date | Audience (millions) | Audience share in % |

1. | „ESC - Das Finale aus Basel“ (Das Erste,17.05.2025) | 3,674 | 59,8% |

2. | „ICH BIN EIN STAR - HOLT MICH HIER RAUS Folge 12“ (RTL, 04.02.2025) | 1,884 | 32,9% |

3. | „ICH BIN EIN STAR - HOLT MICH HIER RAUS Folge 10“ RTL, 02.02.2025) | 1,858 | 27,6% |

4. | „ICH BIN EIN STAR - HOLT MICH HIER RAUS Folge 7“ (RTL, 30.01.2025) | 1,848 | 32,3% |

5. | „ICH BIN EIN STAR - HOLT MICH HIER RAUS Folge 5“ (RTL, 28.01.2025) | 1,831 | 33,4% |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: TV; convention; package no.: 16906 of 08/01/2026

From linear TV to video streaming: shifts within the moving-image market are becoming more visible—also due to expanded AGF measurement

Looking at total usage volume, 2025 shows a further shift within video consumption. While average viewing time for linear TV in 2025 fell by 13 minutes compared with the previous year (-7.7%), average daily video streaming time among the total audience increased from 6 to 8 minutes—an increase of around 21 percent. Growth at this level can be observed across the 14–29 and 30–49 age groups as well as among adults aged 50+.

Even if losses in traditional linear TV cannot yet be offset by the increase in measured streaming usage, the growth reflects both a shift toward time-independent video consumption and the expansion of streaming measurement to include additional providers and offerings.

Streaming providers in comparison – focusing on usage volume

AGF measurement for streaming and convergence offerings captures not only net reach/contacts, but also duration-based performance metrics—such as average usage volume and total usage volume for individual providers and platforms. These facts allow conclusions about how intensively the offerings of particular providers were streamed by all users within a target group.

Across the full year, public service offerings show strong usage among the total audience. Among 14- to 49-year-olds, RTL took the leading position in 2025. Although Amazon Prime Video’s ad-funded on-demand offering has only been included in comparable AGF measurement since November 1, 2025, the streaming service already ranks fifth in the full-year list across all streaming offerings under active AGF measurement.

TOP 5 streaming providers 2025: Usage volume (total) – total audience

Rank | Distributor | Vol. Σ (Houres) |

1. | ARD | 1.234.403.924 |

2. | ZDF Verbund | 1.016.266.506 |

3. | RTL Deutschland | 747.704.649 |

4. | Joyn Plattform | 510.394.187 |

5. | Amazon* | 268.665.632 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026

TOP 5 streaming providers 2025: Usage volume (total) – adults 14–49

Rang | Distributor | Vol. Σ (hours) |

1. | RTL Deutschland | 537.295.421 |

2. | ARD | 408.911.246 |

3. | ZDF Verbund | 308.469.070 |

4. | Joyn Plattform | 297.661.899 |

5. | Amazon* | 191.757.589 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026

Streaming providers in comparison – the relevance of net reach

Net reach is increasingly playing a central role in convergence analysis. This metric indicates how many people within a target group were reached at least once by a media offering. When crossing media-category boundaries, this metric is essential, as it serves as a benchmark for target-group penetration. To enable approximate comparability with usage data for offerings outside AGF measurement, AGF deliberately defined net reach using a 0/1 criterion. This can be refined upon request by all market partners.

TOP 5 streaming providers 2025: Average net reach per day – total audience

Rank | Distributor | Net reach millions |

1. | ARD | 3,488 |

2. | Amazon* | 2,850 |

3. | ZDF Verbund | 2,478 |

4. | RTL Deutschland | 2,173 |

5. | Joyn Plattform | 1,136 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026

TOP 5 streaming providers 2025: Average net reach per day – adults 14–49

Rang | Distributor | Net reach millions |

1. | Amazon* | 1,730 |

2. | ARD | 1,463 |

3. | RTL Deutschland | 1,174 |

4. | ZDF Verbund | 0,969 |

5. | Joyn Plattform | 0,606 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026

Many media outlets work with so-called “widest user circles.” TV is a daily medium and has always been geared toward reporting performance values for individual formats or days in a timely manner. Due to usage fragmentation, cumulative metrics are becoming increasingly important—also for comparability in inter- and intramedia comparisons—to assess the relevance of an offering.

TOP 5 streaming providers: Average cumulative monthly net reach – total audience

Rank | Distributor | cum. Net reach millions |

1. | ARD | 27,145 |

2. | ZDF Verbund | 20,684 |

3. | Amazon* | 20,463 |

4. | RTL Deutschland | 16,879 |

5. | Joyn Plattform | 9,914 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026; own calculations

TOP 5 streaming providers: Average cumulative monthly net reach – adults 14–49

Rang | Distributor | cum. Net reach millions |

1. | ARD | 12,252 |

2. | Amazon* | 10,802 |

3. | ZDF Verbund | 9,071 |

4. | RTL Deutschland | 8,398 |

5. | Joyn Plattform | 5,010 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; Market Standard: Moving Image; analysis type: streaming interval; usage-based; package no.: 16906 of 08/01/2026; own calculations

Convergence data: why looking at preliminary TV data is no longer sufficient

For more than three decades, AGF has provided market players with reliable audience data for linear TV. The distinction between preliminary and final TV data has existed for just as long. For decades, preliminary TV data were seen as already capturing almost all usage of the linear TV format, because there were only minor changes between preliminary and final weighting.

In an era of time- and place-shifted consumption, this perspective—tied to classic linear TV—is often only a first glance over the shoulder: content usage can extend far beyond the traditional TV standard. And therefore beyond final TV weighting as well, because final weighting does not fully capture streaming usage.

In the past, AGF has made efforts to provide the market with new, convergent aggregates. Convergence data and convergent programme brands have been available in AGF systems for some time and are gaining in importance, as they highlight that video consumption no longer takes place only on one big screen and no longer only linearly. In the Moving Image Market Standard, a programme brand is understood as an evaluation unit that enables a convergent view of content. Under one shared brand umbrella, a programme brand bundles identical or similar video offerings of a format—from both traditional TV and digital measurement. This offers the advantage in provider comparisons of viewing video both as a whole and split into TV and streaming. Not least due to unified metrics—such as net reach and usage volume—programme brands enable direct performance comparisons between a pure TV provider and a pure streamer. Programme brands therefore clearly show which distribution paths are more heavily used by specific target groups to access preferred content. And they underscore one thing that is sometimes forgotten amid ambitious discussions about digital measurement: proportionality between linear TV and video streaming—both in relation to the provider itself and with regard to competition.

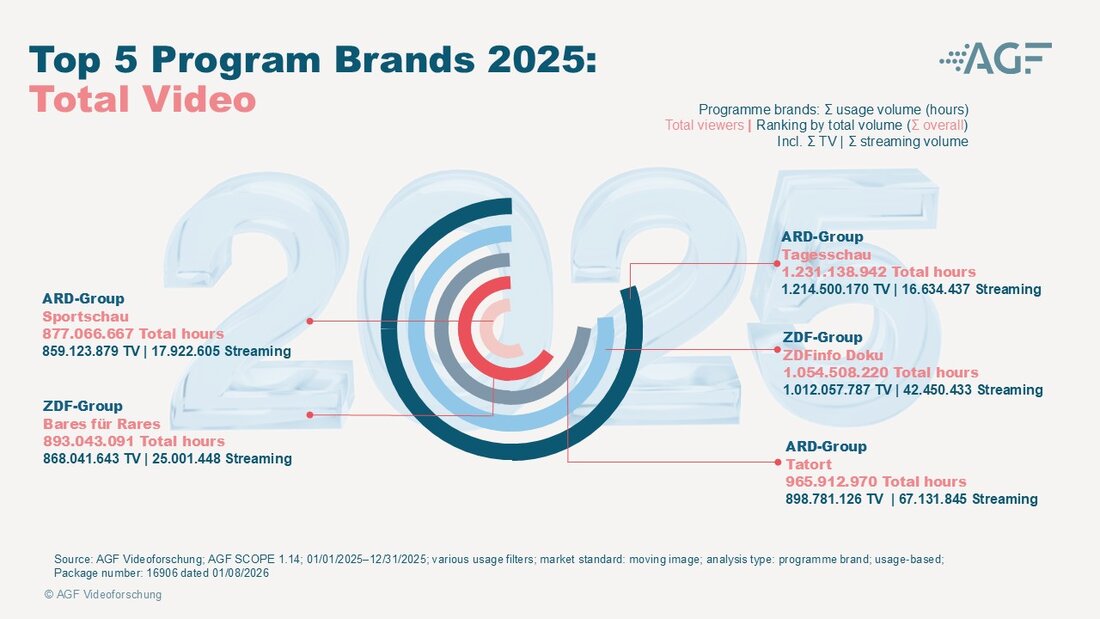

The following programme brands—taking TV and streaming into account (i.e., Total Video)—recorded the highest overall usage in 2025.

Top 5 programme brands 2025: Total Video – total usage volume (hours) – total audience

Rank | Provider | Programme brand | Vol. Σ Total | Vol. Σ TV | Vol. Σ Streaming |

1. | ARD-Gruppe | Tagesschau | 1.231.138.942 | 1.214.500.170 | 16.634.437 |

2. | ZDF-Gruppe | ZDFinfo Doku | 1.054.508.220 | 1.012.057.787 | 42.450.433 |

3. | ARD-Gruppe | Tatort | 965.912.970 | 898.781.126 | 67.131.845 |

4. | ZDF-Gruppe | Bares für Rares | 893.043.091 | 868.041.643 | 25.001.448 |

5. | ARD-Gruppe | Sportschau | 877.066.667 | 859.123.879 | 17.922.605 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

Top 5 programme brands 2025: Total Video – total usage volume (hours) – adults 14–49

Rank | Provider | Programme brand | Vol. Σ Total | Vol. Σ TV | Vol. Σ Streaming |

1. | ZDF-Gruppe | ZDFinfo Doku | 239.919.312 | 225.586.318 | 14.332.994 |

2. | ARD-Gruppe | Tagesschau | 173.545.425 | 164.547.955 | 8.995.552 |

3. | ARD-Gruppe | Sportschau | 134.518.702 | 126.207.734 | 8.297.462 |

4. | ARD-Gruppe | Tatort | 132.615.172 | 105.540.646 | 27.074.526 |

5. | RTL-Gruppe | CSI | 126.873.111 | 121.817.882 | 5.055.115 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

Programme brands with the highest streaming usage in the full year 2025 – usage volume

In the full-year view, based on total usage volume of individual programme brands, the following observations can be made: serial and fictional formats show the highest streaming usage. Among the total audience, established strong ARD brands such as “Sturm der Liebe” lead the ranking, followed by “Tatort” and “Rote Rosen.” In fourth place, Bundesliga on DAZN appears in the Top 5—showing that usage of (live sports) content is not categorically tied to one distribution path; content must be relevant to target groups to be consumed. The majority of DAZN usage takes place digitally, not least due to the heritage of the streaming platform. In fifth place is the long-running RTL success format “Gute Zeiten, schlechte Zeiten.”

Among 14- to 49-year-olds, the picture differs: “Gute Zeiten, schlechte Zeiten” takes the leading position, followed by ARD brands “Tatort” and “Sturm der Liebe.” In fourth place is RTL’s “Das Sommerhaus der Stars – Kampf der Promipaare,” and DAZN’s Bundesliga ranks fifth.

TOP 5 programme brands “Streaming” – full year 2025: total usage volume (hours) – total audience

Rank | Provider | Programme brand | Vol. Σ TV | Vol. Σ Streaming |

1. | ARD-Gruppe | Sturm der Liebe | 275.432.929 | 73.443.724 |

2. | ARD-Gruppe | Tatort | 898.781.126 | 67.131.845 |

3. | ARD-Gruppe | Rote Rosen | 182.231.938 | 54.052.596 |

4. | DAZN-Gruppe | Bundesliga | 20.949.551 | 50.588.908 |

5. | RTL-Gruppe | Gute Zeiten, schlechte Zeiten | 184.098.888 | 47.902.169 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

TOP 5 programme brands “Streaming” – full year 2025: total usage volume (hours) – adults 14–49

Rank | Provider | Programme brand | Vol. Σ TV | Vol. Σ Streaming |

1. | RTL-Gruppe | Gute Zeiten, schlechte Zeiten | 57.726.821 | 35.528.085 |

2. | ARD-Gruppe | Tatort | 105.540.646 | 27.074.526 |

3. | ARD-Gruppe | Sturm der Liebe | 15.024.405 | 24.791.507 |

4. | RTL-Gruppe | Das Sommerhaus der Stars – Kampf der Promipaare | 7.068.515 | 23.989.905 |

5. | DAZN-Gruppe | Bundesliga | 6.510.497 | 22.159.020 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

Programme brands are generally provided to the market in higher aggregates and typically based on net reach per calendar week. Usage volume does not (yet) play a role in that view. The analysis indicates how many people in a target group had at least one contact with content from a programme brand. Based on a monthly view of individual programme brands, the following stand out in the total audience: the Women’s European Championship in summer and ARD’s Tagesschau—especially in the months of the early federal election and subsequent chancellor election. In fifth place, ntv Nachrichten appears as one of RTL’s strongest programme brands.

A similar picture emerges among 14- to 49-year-olds. However, as a new entrant to the AGF system, Amazon Prime Video’s “Maxton Hall” ranks second in its very first month of reporting.

TOP 5 programme brands “Streaming” (month) – cumulative net reach (m) – total audience

Rank | Provider | Programme brand | Month | Cum. Net reach / Streaming |

1. | ARD-Gruppe | Sportschau Fußball-EM | Juli | 5,528 |

2. | ARD-Gruppe | Tagesschau | März | 5,336 |

3. | ARD-Gruppe | Tagesschau | Februar | 5,156 |

4. | ARD-Gruppe | Tagesschau | Mai | 4,849 |

5. | RTL-Gruppe | ntv Nachrichten | Juli | 4,789 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

TOP 5 programme brands “Streaming” (month) – cumulative net reach (m) – adults 14–49

Rank | Provider | Programme brand | Month | Cum. Net reach / Streaming |

1. | ARD-Gruppe | Sportschau Fußball-EM | Juli | 2,855 |

2. | Amazon-Gruppe* | Maxton Hall | November | 2,699 |

3. | ARD-Gruppe | Tagesschau | März | 2,673 |

4. | ARD-Gruppe | Tagesschau | Februar | 2,619 |

5. | ARD-Gruppe | Tagesschau | Januar | 2,564 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

A look at cumulative net reach by calendar week highlights clear audience preferences at a more granular level. Among the total audience, ARD’s Tagesschau and Sportschau Football EURO rank first and second. Places three to five are occupied by RTL programme brands such as IBES – Ich bin ein Star – Holt mich hier raus! or ntv Nachrichten.

The situation changes for 14- to 49-year-olds. Amazon Prime Video’s Maxton Hall takes the leading position, followed by IBES (RTL), Sportschau Football EURO, and Tagesschau (both ARD).

TOP 5 programme brands “Streaming” (CW) – cumulative net reach (m) – total audience

Rank | Provider | Programme brand | Calendar week | Cum. Net reach / Streaming |

1. | ARD-Gruppe | Tagesschau | KW 09 | 2,694 |

2. | ARD-Gruppe | Sportschau Fußball-EM | KW 30 | 2,595 |

3. | RTL-Gruppe | IBES - Ich bin ein Star - Holt mich hier raus! | KW 05 | 2,521 |

4. | RTL-Gruppe | IBES - Ich bin ein Star - Holt mich hier raus! | KW 06 | 2,461 |

5. | RTL-Gruppe | ntv Nachrichten | KW 31 | 2,235 |

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

TOP 5 programme brands “Streaming” (CW) – cumulative net reach (m) – adults 14–49

Rank | Provider | Programme brand | Calendar week | Cum. Net reach / Streaming |

1. | Amazon-Gruppe* | Maxton Hall | KW 46 | 1,461 |

2. | RTL-Gruppe | IBES - Ich bin ein Star - Holt mich hier raus! | KW 05 | 1,437 |

3. | ARD-Gruppe | Sportschau Fußball-EM | KW 30 | 1,432 |

4. | RTL-Gruppe | IBES - Ich bin ein Star - Holt mich hier raus! | KW 06 | 1,384 |

5. | ARD-Gruppe | Tagesschau | KW 09 | 1,329 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF Videoforschung; AGF SCOPE 1.14; 01/01/2025–31/12/2025; various usage filters; Market Standard: Moving Image; analysis type: programme brand; usage-based; package no.: 16906 of 08/01/2026

AGF CENSUS+ and the Top 10 of 2025

In 2025, AGF not only provided the market with programme brands, but also began reporting census data for individual videos via CENSUS+. Census data are a direct output of Nielsen’s technical measurement. They are available quickly and represent the gross total of all plays of an individual video within a reporting period—however, without sociodemographic information.

Rank | Provider | Video Title | Views (Mio.) |

1. | ARD-Gruppe | Tatort | Liebeswut | 01.03.2024 21:20 | 6,214 |

2. | Amazon-Gruppe* | Maxton Hall – The World Between Us S2E1 | 5,304 |

3. | ZDF-Gruppe | Herzkino I Verhängnisvolle Leidenschaft Sylt | 4,890 |

4. | Amazon-Gruppe* | Maxton Hall – The World Between Us S2E2 | 4,682 |

5. | Amazon-Gruppe* | Maxton Hall - The World Between Us S2E3 | 4,517 |

6. | Amazon-Gruppe* | Maxton Hall - The World Between Us S2E4 | 4,001 |

7. | ZDF-Gruppe | Der Bergdoktor I Herzschmerzen | 3,831 |

8. | RTL-Gruppe | Das Sommerhaus der Starts - Kampf der Promipaare I Staffel 10 – Folge 1 | 3,818 |

9. | Amazon-Gruppe* | Playdate | 3,636 |

10. | Amazon-Gruppe* | Maxton Hall - The World Between Us S2E5 | 3,607 |

* reported since 01/11/2025 (ad-funded VOD)

Source: AGF; AGF CENSUS+ v1.4.7; analysis type: streaming videos; census data from technical measurement; offerings under AGF measurement; through 04/01/2026

Census data enable important insights into the performance of individual video titles and complement AGF’s data portfolio in an increasingly convergent video world—where for different questions there is no longer just one single standard or default, as content forms and distribution logics continue to fragment more clearly.

“In a toolbox, there’s more than just a hammer or a screwdriver—and in 2026 we have a lot ahead of us,” says Niederauer-Kopf.