Frankfurt, 22 June 2020. Use of video on demand continues to rise. More than a third of respondents over 14 years of age state that they used pay video on demand offerings in the previous three months. In the 2019-II Platform study it was 32.4 percent, but now 36.3 percent use Netflix and the other providers. Disney+ started in Germany only on 24 March 2020 but immediately made it into the five most-used pay offerings. These are the findings of the TV-Platform 2020-I study by AGF Videoforschung.

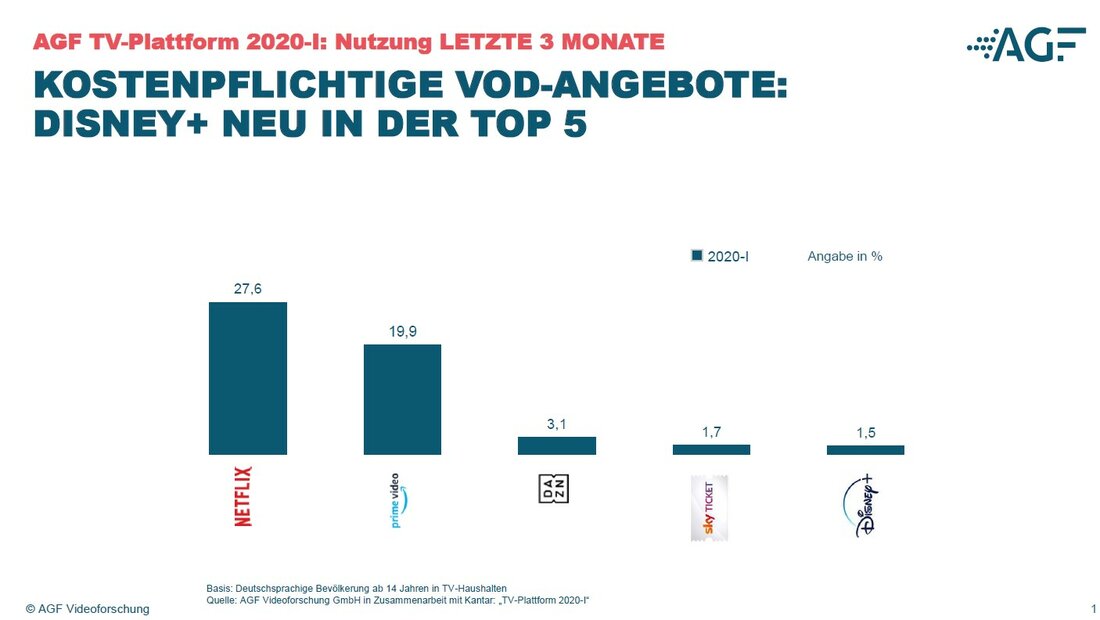

“Developments show that the market for video streaming is continuing to evolve,” says Kerstin Niederauer-Kopf, Chairperson of AGF Executive Management. Netflix is by far the most used pay video on demand service. 27.6 percent of respondents said they had watched the platform within the previous three months – around 3 percentage points more than in TV-Platform 2019-II. In second place is Amazon Prime Video with 19.9 percent, followed by sport streaming service DAZN (3.1 percent), Sky Ticket (1.7 percent) and Disney+ (1.5 percent).

While pay video on demand has continued to gain ground, the share of respondents saying they watched pay TV within the previous three months is constant, at 15 percent. “Pay TV has remained at a very stable level for several survey waves,” says Kerstin Niederauer-Kopf.

Twice yearly, for the Platform study the Market research institute Kantar surveys over 2500 respondents per wave from the German-speaking population age 14 and up in TV households. This year the fieldwork coincided in part with the start of the corona pandemic in Germany, so for the spring wave Kantar had to overcome some methodological challenges. Still, they were able to survey about 1700 people. Some of the household inspections normally done in the study were done by CATI, in order to comply with contact restrictions.

With regard to use in the previous four weeks, 29.1 percent of respondents said they had used free online offerings by TV broadcasters. The likewise free platform YouTube was used by one in two respondents within the previous four weeks.

The number of smart TV households has grown significantly since the autumn of 2019. In TV-Platform 2019-II only 36.0 percent had internet-capable TVs, compared to 43.9 percent in the most recent survey. More and more households also use the red button that lets viewers access functions from within the TV program. The red button was used by 23.3 percent of respondents in the autumn survey, while now that number is 28.8 percent. In this connection it should be noted that these changes may be associated with changed video usage during the corona pandemic.

Those with internet-capable TVs enjoy watching online content on them. 59.3 percent of respondents said they watched programming from TV broadcasters on the big screen. 76.2 percent of Netflix subscribers with a TV watch series and films on it, as do 78.9 percent of Prime Video users. YouTube is the only channel primarily viewed on smartphones (67.3 percent) and less on smart TVs (28.0 percent).

“The television - or the big screen - remains the most attractive screen for users to watch relevant content on. On the big screen, high-quality video offerings get a lean-back effect that can be considered as demonstrated for linear TV. This positive reception situation clearly pays off for those content providers that distribute their quality content widely on the respective channels,” explains Kerstin Niederauer-Kopf.

Method profile

Study name: TV-Platform

Survey: Twice yearly

Institute: Kantar

Survey method: Computer-assisted personal interviews (CAPI) and household inspection / 2020-I due to corona also with additional computer-assisted telephone interviews by professional qualified face-to-face interviewers (CATI)

Sample: Representative random sample in two waves, each approx. n=2500 per year / 2020-I: Due to a field break and longer CATI interviews, reduced number of cases n=1683

Fieldwork: Wave 2019-II: 26 Aug.-13 Oct. 2019

Wave 2020-I: 2-20 Mar. 2020 and 1-20 Apr. 2020

Population: German-speaking population aged 14 years and up in TV households (private households with German-speaking primary earner or persons in these households 3 years and up)

About AGF Videoforschung GmbH (www.agf.de)

AGF Videoforschung GmbH specializes in impartial video research. AGF continuously tracks the use of video content in Germany on a quantitative basis and analyses the data collected. It invests many millions of euros per year to continuously refine its instruments in order to deliver reliable data on the use of video content to the market on a daily basis. AGF consults closely with all market partners, including licensed TV stations, advertisers and media agencies.

Press contact:

Juliane Paperlein

Head of Corporate Communication | AGF Videoforschung GmbH |

T +49 69 955 260-55 |